Nigeria’s infrastructure and aviation sectors may soon witness a historic boost as billionaire investor Adebayo Ogunlesi signaled fresh interest in bringing major capital into the country.

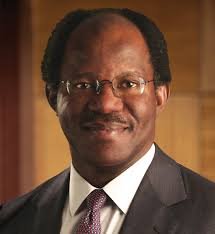

Ogunlesi, the Nigerian-born founder of Global Infrastructure Partners (GIP), revealed his plans after a private meeting with President Bola Tinubu in Abuja. With a personal fortune estimated at $2.6 billion and a seat on the board of Goldman Sachs, Ogunlesi is one of the most influential figures in global finance. His firm GIP, which manages assets worth over $100 billion worldwide, is credited with transforming airports, energy projects, and seaports across several continents.

Speaking to State House correspondents, the 71-year-old investor said his group was already reviewing opportunities across multiple sectors in Nigeria, particularly ports, energy, and aviation. While keeping details close to his chest, Ogunlesi hinted that significant announcements could follow soon. “We’re making investments in Nigeria. We explored additional opportunities. I’m not going to tell you what they are. Just wait. Watch this space,” he said.

Read also:

- Bayelsa to hold Entrepreneurship, Business Innovation Summit

- NGO trains 50 women on business, financial literacy in Kano

- Peter Obi questions DBN’s claim of ₦1 Trillion disbursement to small businesses

Ogunlesi admitted that Nigeria’s ports were long overdue for world-class private sector participation. “We already operate ports in Lomé and Cotonou, but none in Nigeria. I asked Mr. President for forgiveness, and being the gentleman he is, he forgave me. But he told me, ‘You must bring port investment to Nigeria.’ That’s an area we are looking at closely,” he disclosed.

On aviation, he noted that his name has long been associated with the acquisition of London’s Gatwick Airport through GIP. “People describe me as the man who bought Gatwick Airport. While I didn’t personally buy it, the aviation sector is indeed one of our strong interests, and Nigeria has huge potential.”

The investor also highlighted Nigeria’s vast energy resources, describing the country as “a huge gas province” that remains underutilized. Drawing parallels with GIP’s ongoing LNG projects in Texas and Australia, he emphasized the possibility of replicating such ventures locally. Renewable energy, he added, was another frontier that Nigeria could tap for export-led growth.

Ogunlesi stressed that the key challenge for Nigeria is to leverage recent reforms under President Tinubu to position the country as a globally competitive, export-driven economy. “Our President has done fundamental reform, and that reform has invited all these people you’re seeing. The next thing is for us to lead an export-led economy. The hope is on the rise,” he said.

Ogunlesi’s credibility as a transformative investor is well established. Since founding GIP in 2006 with backing from Credit Suisse and General Electric, he has overseen acquisitions of strategic assets including London’s Gatwick and Edinburgh airports, energy pipelines, and global shipping terminals. In 2024, GIP was sold to BlackRock in a record $12.5 billion deal, further cementing his global influence.

Beyond infrastructure, Ogunlesi serves on the boards of Goldman Sachs and OpenAI, a role he took up in 2025 that increased his exposure in the global technology sector. Forbes ranked him among the 50 wealthiest Black Americans in 2024 with a fortune of $1.7 billion, a figure that has since climbed above $2.6 billion.

With Ogunlesi’s fresh signals of interest, industry watchers say Nigeria may soon witness one of the largest waves of private capital into its critical infrastructure, with ports, aviation, and energy at the center of the new push.