By Adodo Osewengie

A couple of weeks ago, the media was awash with the news that a vital asset belonging to the country of Uganda, the Entebbe International Airport, was confiscated by China’s EXIM Bank over the country’s inability to repay a loan it took from China.

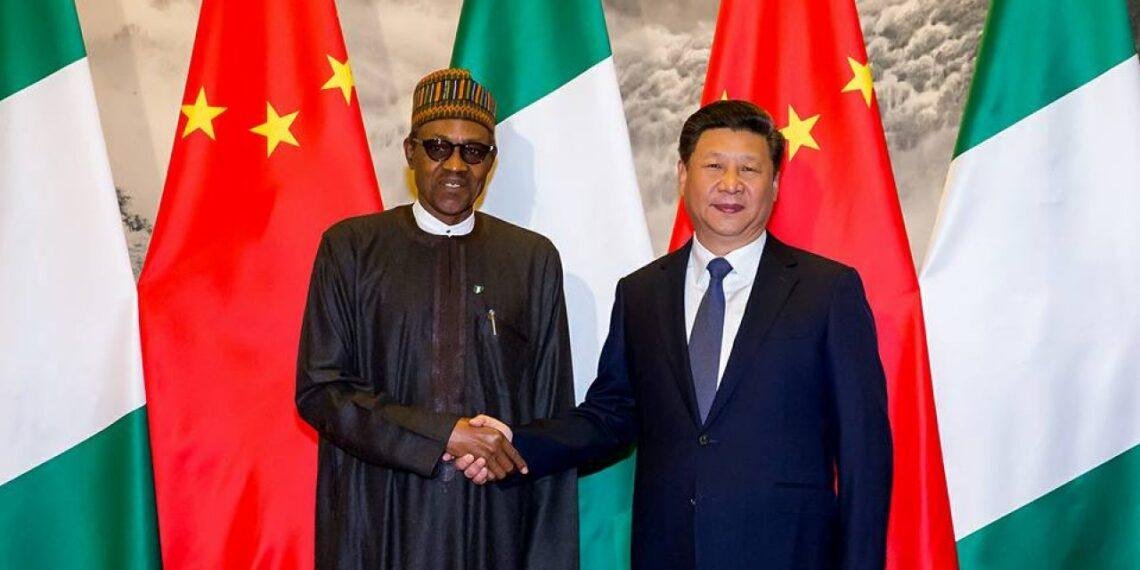

This incident threw concerned Nigerians to ask about the fate of the nation, Nigeria, owing to the series of loans taken and agreements reached with the Republic of China to develop some key infrastructure in the country.

Why do some Nigerians believe that the loan taken has been beneficial in developing the railway sectors, majority of them are much concerned about the resultant effect it will bear on the country’s sovereignty if Nigeria fails to repay the loans on the stipulated timeframe.

According to some reports, Uganda’s request to renegotiate the terms binding the $200,000,000 loan issued in 2015 to rehabilitate and upgrade the standard of the Entebbe airport under “certain clauses” was outrightly turned down by the officials from China.

While the Ugandan and Chinese governments have reputed the trending reports, financial analysts, economists and concerned citizens of Nigeria have persistently revealed they are unsettled over Nigeria-China loan pacts.

According to Kadiri Abdulrahman of News Agency of Nigeria, NAN, some stakeholders raised concerns that the nature of the loan agreements with China was capable of compromising the country’s sovereignty.

He recalled that in May 2020, the House of Representatives mandated some of its committees to investigate all China-Nigeria loan agreements, ascertain the viability of the facilities, then regularise and renegotiate them when necessary.

Of particular interest was a sovereign guarantee clause in the agreements, which stakeholders fear it may seem Nigeria sign away its sovereignty in the event of a payment default.

However, NAN noted that Nigeria’s transportation minister, Rotimi Amaechi, explained that the purpose of the clause was to allow China to pursue paths, including arbitration, to settle possible disputes over payments.

Amaechi said, “They are saying; if you are not able to pay, do not stop us from taking back those items that will help us recover our funds.

“And it is a standard clause, whether it’s with America you signed it or with Britain or any country because they want to know that they can recover their money,’’ Amaechi said.

Findings by the News Agency of Nigeria (NAN) reveal that the of country’s total debt stock of 92.9 billion dollars, the foreign component of it is 37.9 billion dollars, which includes debts from multilateral sources, bilateral sources, commercial loans, and promissory notes.

Loans from China fall under bilateral loans and, together with loans from other sources like France, Japan, India and Germany total 4.3 billion dollars; or 11.59 percent of the total debt stock.

The Chinese component of the loans presently stands at 3.59 billion dollars, constituting 9.47 percent of the country’s total foreign debt stock.

This showed that China is not the highest source of borrowing or the major source of funding for the Nigerian government.

According to Patience Oniha, Director-General of the Debt Management Office ( DMO), loans from China are mainly concessional loans with interest rates of 2.50 percent per annum, tenor of 20 years and a grace period of seven years.

Oniha also clarified that no national asset was tagged as collateral for the loans.

“Nigeria’s total foreign debt stock as of Sept. 30 was 37.9 billion dollars, this figure comprised the external debt stock of the Federal Government, 36 state governments and the Federal Capital Territory.

“But total loans from China stand at 3.59 billion dollars, which is 9.47 percent of the total external debt. The loans did not require any national asset as collateral; they were largely concessional,’’ she said.

She explained that before foreign loans were contracted, some sensitive steps were taken by multiple institutions of government to ensure that they were beneficial to the nation.

“Before any foreign loan is contracted, including the issuance of Eurobond, they are approved by the Federal Executive Council and thereafter, the National Assembly.

“An important and extremely critical step is that the loan agreements are approved by the Federal Ministry of Justice.

“An opinion is issued by the Attorney-General of the Federation and Minister of Justice before the agreements are signed.

“Several measures which operate seamlessly have been put in place to ensure that data on debt are available and that debt is serviced as at when due. Provisions are made explicitly for debt service in the annual budgets,’’ she said.

Oniha explained that the loans agreements provided some steps to take to resolve disputes when they arise.

“The first action is that the parties should resolve it within themselves and if that fails, they go to arbitration.“In other words, a lender, in this case, China, would not just pounce on an asset at the first sign of a dispute, including defaults,’’ she said.

She explained that the DMO maintained proper records of debts, provided projections for debt service and processed the actual payments for debt service.

She added that the low-interest rate offered by the Chinese reduced the interest cost to the government while the long tenor enabled repayment of the principal sum of the loans over many years.

Some stakeholders, however, condemned the seeming, perpetual dependence on loans by the government to fund infrastructure as well as budget deficits.

Read Also: 18 bodies recovered as US military helicopter, passenger aircraft collide mid-air

An economist, Mr. Tope Fasua, advised the Federal Government to improve on the budgeting system to check deficit financing and make the annual budgets more impactful.

Fasua said that though borrowing had become imperative due to prevailing circumstances, especially with the advent of COVID-19, such borrowings should be judiciously utilized to improve infrastructure that can grow the economy.

“Unfortunately, we have found ourselves in a difficult scenario due to the COVID-19 pandemic and falling crude oil prices and we just have to go borrowing like most other countries in the world.

“Government should ensure that our borrowings are effectively utilized for optimum economic impact,’’ he said.

However, with the country’s National debt with Gross Domestic Product (GDP) at 35.51 percent, some analysts opine that the debt situation is still within reasonable limits.

According to a study conducted by the World Bank, a debt to GDP ratio that exceeds 77 percent for an extended period of time may result in an adverse impact on economic growth.

This implies that the Nigerian debt situation is not alarming when compared to the country’s GDP.

Mr. Laoye Jaiyeola, Chief Executive Officer of the National Economic Summit Group (NESG), said that though Nigeria’s debt to GDP ratio could be considered low, the revenue that went into debt servicing was still on the high side.

Jaiyeola opined that expending between 25 percent and 30 percent of national revenue on debt servicing, as presently done by the Nigerian government, was not sustainable.

He urged the Federal Government to adopt tough but necessary policy choices to improve on its revenue and reduce its dependence on foreign and local loans to fund the budget deficit.

“We should all be worried about the rising debt profile of the country. Some people say that the debt to GDP ratio is still low. It could be low, but servicing debt is still a challenge,” he said.

He suggested a drastic cut in the running cost of governance, reduction in recurrent expenditure, as well as the removal of subsidies in electricity and petroleum products, as a way of reducing the debt burden. (NAN)