By Johnmark Ukoko

Contrary to the views of the Federal Government, Central Bank of Nigeria (CBN) and some government’s agencies that the country’s Gross Domestic Product (GDP) and other economic indices will grow significantly in 2022, an economic expert has panned such thinking, describing it as “mere wishful thinking’ not backed by economic parameters.

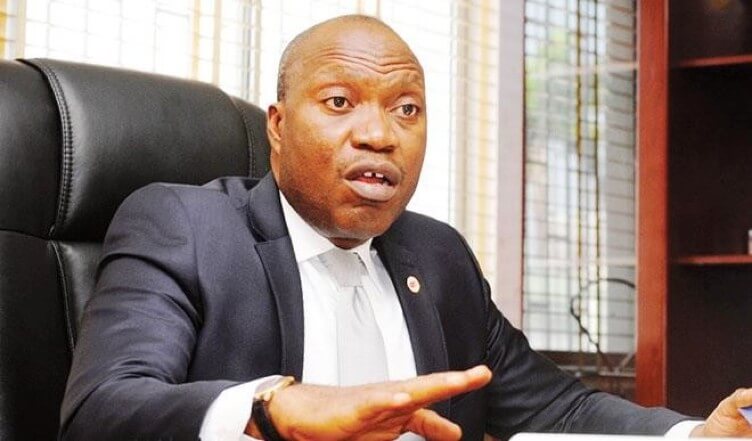

Managing Director and Chief Executive Officer (MD/ CEO) of Cowry Assets Management, Johnson Chukwu, stated this yesterday while addressing the Finance Correspondents on the theme: Foreign Direct Investment Outlook for 2021 And Its Implementation for 2022 in Lagos.

He disclosed that the government has failed to implement friendly policies that would have attracted foreign investors into the country, adding that those who came a few years ago were all moving out of the country due to the harsh economic policies.

He stressed that foreign investors will go to a country with huge market and purchasing power, insisting that while Nigeria has a huge population it does not possess huge economic power.

“It is true that Nigeria is about the seventh most populated country in the world, but, when it comes to the purchasing power Nigeria is not in the top 30th economy. Most of our people don’t have economic power to purchase the needed goods, hence foreign investors will take their investment to the climes where the people have the purchasing power.

“A case in point is South Africa which is about a third of Nigeria’s population, but has more people than Nigeria in terms of purchasing power. That explains why all the car production companies have plants in South Africa where they produce for African countries and shipped them from there.

Read Also: Biden blocked the first Black woman from the Supreme Court

“Many Nigerians drive BMW car, but how many of us know that the car is produced in South Africa. Many of the South Africans can take car loans to buy brand new cars, but that can’t be said of Nigeria,” he stated.

He bemoaned the condition of the country’s ports, adding that it is cheaper to shipped cargoes to the neighbouring countries ports and bring them to the country by roads than shipped such cargoes to our various ports due to the sharp malpractices in our ports, adding that the ports situation has also affected the foreign direct investment inflow into the country.

According to him, capital will flow to the country with good infrastructure, stable laws, good security and quick resolution of legal issues

He lamented that the scarcity of Forex, high inflation and high-interest rate are among the reasons why many foreign investors were in a haste to take their funds out of the country, adding all these issues are reasons the country’s economy will not grow much in the current year and that the country’s leadership has not demonstrated capacity to turns things around in the new year.

” A wise investor will go to a country with low or modest inflation, stable foreign exchange, and easy access to forex. All these were lacking in Nigeria currently, so I don’t see where the government, CBN and other government agencies were getting their optimism.

“The way I see things currently unless the government takes some bold and sound economic decisions in the next few months, the country and its people were for another difficult long year,” he said.

The Cowry Asset Management boss urged the government to learn from the experience of the country in the Telecom sector, adding that in all the years of NITEL the country didn’t have up to one million lines, but in the past 21 years of the deregulation of the Telecom sector, nearly every Nigerian adults have at least a line, which is over 100 million of functional lines.