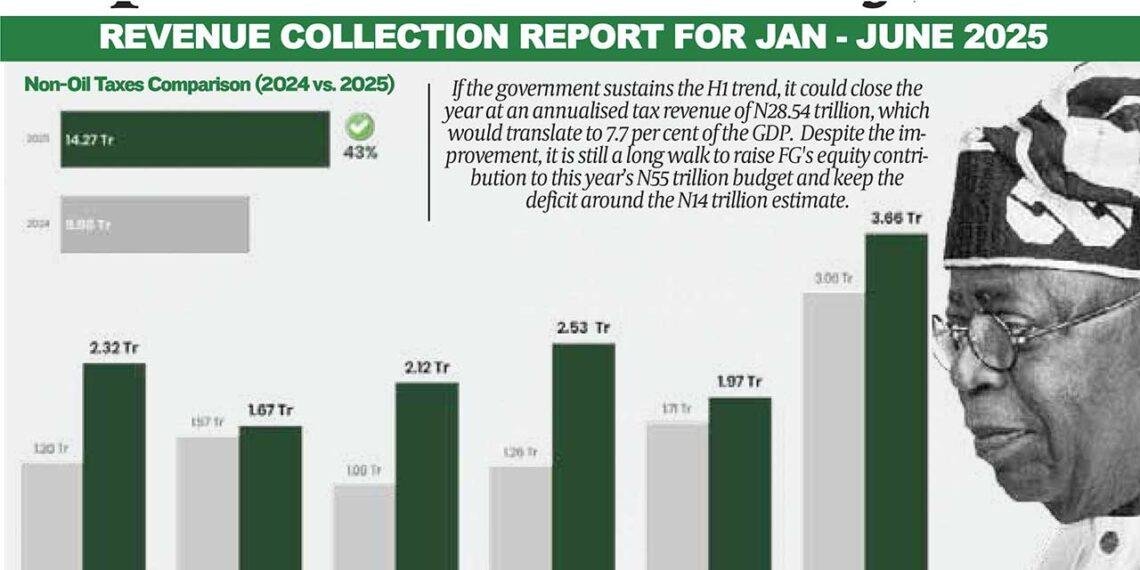

Nigeria’s Federal Inland Revenue Service (FIRS) has reported a 43% surge in tax revenue for the first half of 2025, collecting N14.27 trillion compared to N9.98 trillion in the same period of 2024. This significant increase, which surpassed the baseline growth target of 16.4%, signals a transformative shift in Nigeria’s economic landscape. With non-oil taxes rising by 44.2% to N10.64 trillion and oil taxes by 39.4% to N3.63 trillion, the country is on track to meet its ambitious full-year target of N25.2 trillion. But what does this unprecedented revenue growth mean for Nigeria, its economy, and its citizens?

A Step Toward Economic Resilience

The 43% tax revenue increase reflects Nigeria’s ongoing efforts to diversify its economy and reduce reliance on volatile oil income. Historically, oil has accounted for a significant portion of government revenue, but fluctuations in global oil prices have exposed the risks of this dependency. The robust growth in non-oil tax revenue, which now constitutes a substantial share of collections, underscores the success of reforms aimed at broadening the tax base. This shift is critical as Nigeria grapples with a rebased GDP and a first-quarter 2025 growth estimate of 3.13%, signaling economic resilience despite global and domestic challenges.

The revenue surge is attributed to improved compliance, intensified tax tracking in the extractive sector, and broader enforcement strategies. Additionally, the signing of four new tax laws. These laws aim to simplify tax compliance, reduce burdens on low-income earners and small businesses, and enhance revenue collection efficiency.

Implications for Public Services and Infrastructure

Increased tax revenue provides the government with greater fiscal space to fund essential public services. Nigeria’s low tax-to-GDP ratio, currently around 13% compared to the African average of 16–18%, has long limited investments in infrastructure, healthcare, and education. The additional N14.27 trillion collected in the first half of 2025 could pave the way for improved roads, schools, and hospitals, addressing critical needs in a country where economic hardship remains widespread. President Bola Tinubu has emphasized that these reforms aim to raise the tax-to-GDP ratio to 18% by 2030, which could further enhance funding for public services without overburdening vulnerable citizens.

For low-income households, the new tax laws offer tangible relief. Individuals earning up to N1 million annually will benefit from a N200,000 rent relief, effectively exempting them from income tax. Small businesses with turnovers below N50 million are now exempt from company income tax and face simpler filing requirements, easing financial pressures and encouraging growth in the informal sector. These measures align with the government’s goal of protecting low-income earners while ensuring higher contributions from high-income individuals and luxury consumers.

Challenges and Public Sentiment

Despite the positive outlook, challenges remain. Posts on X reflect mixed sentiments, with some expressing concern over continued borrowing despite revenue gains, highlighting the need for greater fiscal discipline. Others, including the Lagos Chamber of Commerce and Industry, caution that while the revenue increase and GDP rebasing are promising, they have yet to translate into improved living standards for many Nigerians facing harsh economic conditions.

Read also:

- Tinubu New Tax Law: What every Nigerian must know

- Tinubu’s New Tax Law: Nigerians earning N250,000 or less monthly to be exempt from tax starting 2026

- Tinubu signs controversial tax reform bills into law amid northern opposition

Public trust and awareness are critical for the success of these reforms. Taiwo Oyedele, head of the Presidential Fiscal Policy and Tax Reform Committee, noted that 90% of Nigerians support the tax reform bills, but effective implementation depends on building confidence in the system. Past issues, such as overlapping taxes and inefficient collection, have deterred compliance, particularly among small businesses. The introduction of the Nigeria Revenue Service (NRS), a Tax Ombudsman, and a Tax Appeal Tribunal aims to address these concerns by enhancing transparency and dispute resolution.

Economic Diversification and Global Competitiveness

The tax revenue increase aligns with Nigeria’s broader economic strategy to boost its tax-to-GDP ratio and reduce reliance on borrowing, with the country’s debt standing at approximately N77 trillion in 2023. By strengthening non-oil sectors such as agriculture, solid minerals, and gas, Nigeria aims to enhance its global competitiveness. The new tax laws also introduce measures to attract investment, such as reduced corporate tax rates (from 30% to 27.5% in 2025 and 25% thereafter) and tax credits for VAT paid on business expenses. These incentives could stimulate growth in key industries, creating jobs and fostering economic stability.

However, analysts warn that without addressing underlying issues like inflation, currency fluctuations, and insecurity, the benefits of increased revenue may be limited. The rebasing of Nigeria’s GDP to N372.82 trillion in nominal terms reflects a larger economy, but macroeconomic challenges, such as sluggish growth and poverty, persist.

The 43% tax revenue increase marks a pivotal moment for Nigeria’s economic trajectory. It offers the potential for greater investment in public services, reduced borrowing, and a more diversified economy. However, the government must prioritize transparency, efficient use of funds, and public engagement to maintain trust and ensure equitable benefits. As Nigeria navigates this transformative period, the success of these reforms will depend on their ability to translate revenue gains into tangible improvements in the lives of its citizens.

By fostering a fairer, more efficient tax system and leveraging the revenue surge to address pressing needs, Nigeria has an opportunity to redefine its economic future. The road ahead requires careful implementation, but the 43% increase is a promising step toward sustainable growth and prosperity.