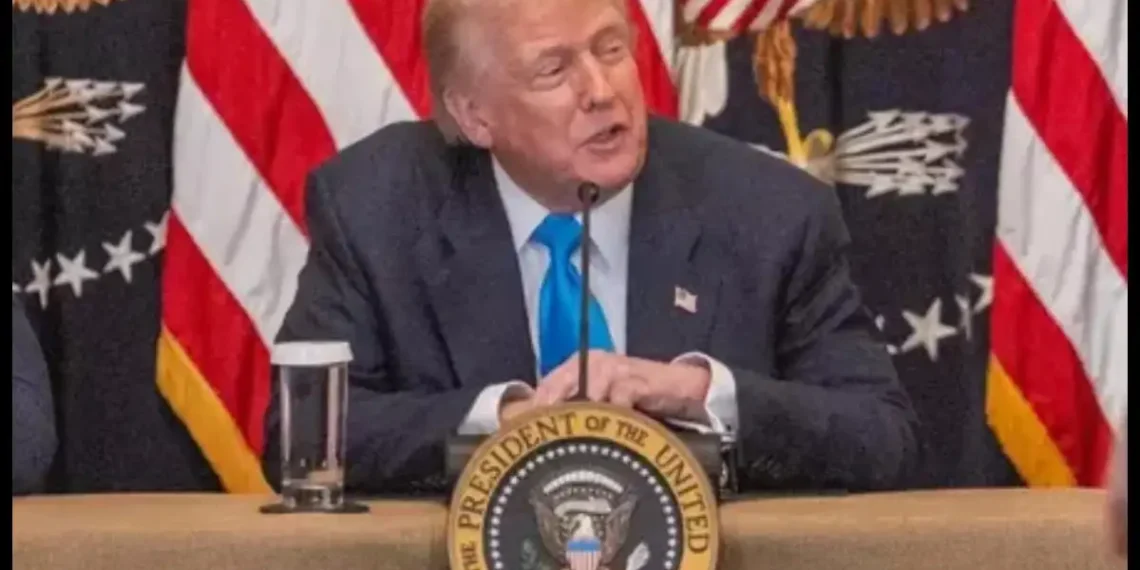

In a seismic shift for the U.S. housing market, President Donald Trump has announced immediate steps to prohibit large institutional investors, such as BlackRock, Vanguard, State Street, and Blackstone, from purchasing additional single-family homes. This move, revealed via a Truth Social post on January 7, 2026, aims to curb what Trump describes as corporate dominance in residential real estate, which he argues has driven up prices and sidelined everyday Americans from homeownership. With housing affordability at historic lows amid lingering inflation pressures, the policy could reshape the market, but it also raises questions about its enforcement, economic ripple effects, and long-term impact on families across the nation.

The Backdrop: How Wall Street Invaded Main Street

Over the past decade, institutional investors have transformed the single-family housing landscape. Following the 2008 financial crisis, firms like Blackstone and Invitation Homes (a Blackstone-backed entity) began snapping up foreclosed properties at bargain prices, converting them into vast rental portfolios. Today, these entities own tens of thousands of homes, particularly in high-growth areas like the Sun Belt states. BlackRock and Vanguard, as major asset managers, have indirect stakes through funds and REITs (Real Estate Investment Trusts), while State Street manages trillions in assets that include real estate holdings.

This corporate buying spree has been blamed for exacerbating the housing shortage. According to industry data, institutional investors accounted for about 15-20% of single-family home purchases in key markets during peak years, outbidding individual buyers and inflating prices. Trump highlighted this in his announcement, stating, “The American Dream is increasingly out of reach for far too many families, especially young people who are being crushed by record-high inflation.” He emphasised that “people live in homes, not corporations,” positioning the ban as a direct assault on Wall Street’s influence over everyday life.

The president’s plan includes signing an executive order to implement the ban swiftly, with a call to Congress for permanent legislation. While details remain sparse, Trump teased more revelations during his upcoming address at the World Economic Forum in Davos; the policy targets “large institutional investors,” likely defined by asset size or portfolio thresholds to exempt smaller players.

Read Also:

- Trump orders US withdrawal from 66 international organisations, says they no longer serve American interests

- Army chief warns Trump, Netanyahu against interfering in Iran’s affairs

- European allies back Denmark over Trump’s threat to annex Greenland

Immediate Market Shockwaves

The announcement sent shockwaves through financial markets. Shares of major real estate firms plummeted: Blackstone dropped over 5%, while REITs focused on single-family rentals saw even steeper declines. Analysts predict that if enforced, the ban could force these investors to divest existing holdings, potentially flooding the market with thousands of properties and easing supply constraints. However, sceptics warn of short-term volatility, including higher borrowing costs if banks and funds pull back from real estate financing.

What This Means for American Citizens

For millions of Americans grappling with skyrocketing home prices, where the median home now costs over $400,000 in many areas, this policy could be a game-changer. Here’s a breakdown of the potential implications:

- Boost to Homeownership Affordability: By removing deep-pocketed competitors, first-time buyers and families may find it easier to secure homes without being outbid by cash offers from corporations. This aligns with Trump’s broader agenda to “restore the American Dream,” potentially lowering entry barriers for millennials and Gen Z, who have been locked out of the market. Experts estimate that curbing institutional buying could reduce home price growth by 2-5% annually in affected regions.

- Rental Market Dynamics: On the flip side, renters might face mixed outcomes. Institutional landlords often provide standardised, professionally managed rentals, which could become scarcer if these firms are sidelined. This might lead to higher rents in the short term due to reduced supply, though proponents argue smaller landlords could fill the gap, fostering more localised and affordable options. For citizens in high-rent cities like Atlanta or Phoenix—hotspots for corporate ownership, the ban could eventually stabilise or even decrease rental costs as more homes hit the for-sale market.

- Economic Equity and Wealth Building: Homeownership remains a cornerstone of wealth accumulation for middle-class families. By prioritising individuals over institutions, the policy could help close racial and generational wealth gaps. Black and Hispanic households, disproportionately renters, stand to gain if more properties become available for purchase. However, if the ban disrupts financing, it might inadvertently raise mortgage rates, offsetting some benefits.

- Potential Downsides and Challenges: Critics, including real estate lobbyists, argue the move could deter investment in housing development, slowing new construction at a time when the U.S. faces a shortage of millions of units. Enforcement poses hurdles: How will the government distinguish between “large” investors and family offices? Legal challenges from affected firms are inevitable, potentially tying up the policy in courts. Additionally, in rural or less desirable areas, institutional buyers have sometimes revitalised neglected properties, without them, some neighbourhoods might see slower maintenance or investment.

Broader Reactions and the Road Ahead

The policy has drawn praise from housing advocates and populist figures, who see it as a long-overdue check on corporate greed. Conversely, Wall Street insiders decry it as government overreach that could stifle economic growth. As Trump prepares to elaborate in Davos, all eyes are on Congress, where Republican majorities might fast-track codification, though bipartisan support could hinge on amendments for small investors.

In essence, Trump’s ban represents a populist pivot in housing policy, prioritising citizens over capital. For American families, it promises a fairer shot at owning a piece of the dream, but only time will tell if it delivers stability or sparks unintended chaos in one of the economy’s most vital sectors.