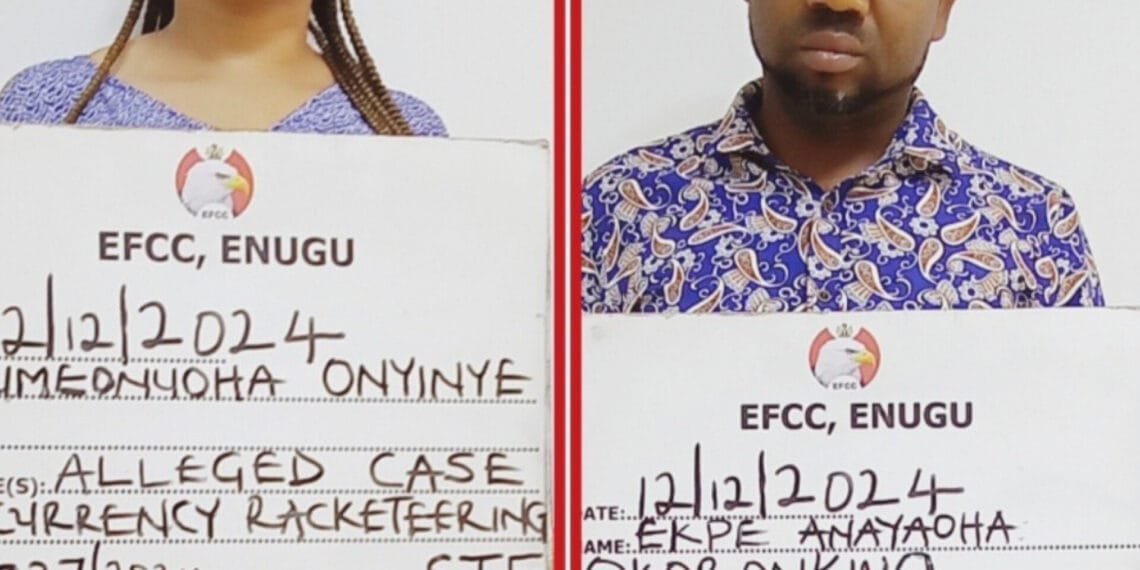

The Economic and Financial Crimes Commission (EFCC) has arraigned two employees of a new generation bank, Ekpe Anayaoha Okoronkwo and Umeonuoha Onyinye, for allegedly selling newly-minted Naira notes totaling N500,000.

The Enugu Zonal Directorate of the EFCC brought the suspects before Justice Mohammed Garba Umar of the Federal High Court, Enugu State, on Thursday, December 12, 2024. According to Dele Oyewale, Head of Media and Publicity for the EFCC, the suspects face charges of currency racketeering under the Central Bank of Nigeria (CBN) Act, 2007.

The charge reads: “That you, Ekpe Anayaoha Okoronkwo and Umeonuoha Onyinye, sometime in October 2024 at Enugu, within the jurisdiction of the Federal High Court of Nigeria, did sell a total sum of Five Hundred Thousand Naira (N500,000.00) mints in Two Hundred Naira Notes (N200) denominations, issued by the Central Bank of Nigeria to one Husseini Ibrahim, thereby committing an offence contrary to Section 21 (4) of the Central Bank of Nigeria Act, 2007 and punishable under Section 21 (1) of the same Act.”

During the court proceedings, Okoronkwo pleaded guilty, while Onyinye entered a not-guilty plea. Following their pleas, EFCC counsel Rotimi Ajobiewe requested an adjournment to review the facts for Okoronkwo and prepare for trial against Onyinye.

Read also: Peter Obi calls for respect of rule of law, human rights in Nigeria

In defense of Onyinye, counsel C.N. Agama requested that she be remanded in EFCC custody pending a bail hearing. Justice Umar adjourned the case to January 15, 2025, for the hearing of Onyinye’s bail application and the sentencing of Okoronkwo. Both suspects were subsequently remanded at the Enugu State Correctional Facility.

The suspects were arrested on November 15, 2024, at their workplace on Okpara Avenue, Enugu, following intelligence reports linking them to the illegal sale of freshly-minted Naira notes. Investigations revealed that the duo allegedly sold N500,000 in N200 denominations to one Husseini Ibrahim, raising concerns about unethical practices within the banking sector.