Africa’s largest economy, Nigeria has shattered decades of trade deficits to post its inaugural trade surplus, with exports surging past imports by a staggering N12.64 trillion in the first half of 2025. The breakthrough, unveiled in fresh data from the National Bureau of Statistics (NBS), signals a seismic shift in the nation’s economic fortunes, fueled by booming crude oil revenues and nascent diversification efforts amid a battered naira.

The figures paint a portrait of unbridled optimism: Total trade volume rocketed to N74.06 trillion between January and June, with exports clocking in at N43.35 trillion – a robust 141% of imports – while imports tallied N30.71 trillion. This N12.64 trillion surplus marks not just a numerical triumph but a psychological victory for a country long plagued by chronic imbalances that drained foreign reserves and fueled currency volatility.

“This is the first time in Nigeria’s recorded economic history that we’ve seen exports sustainably outpace imports over a full half-year period,” said Dr. Fatima Bello, chief economist at Lagos-based Veritas Capital Partners. “It’s a green light for policymakers, but the real test will be sustaining it beyond oil’s whims.”

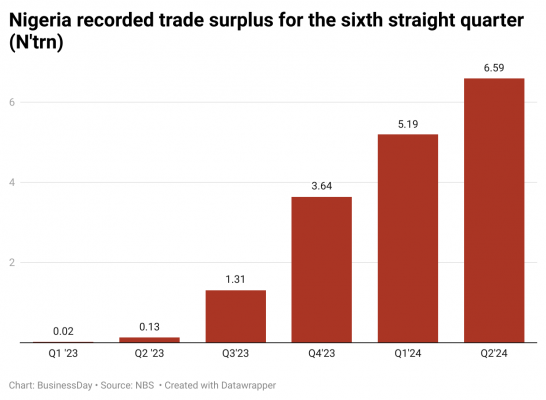

Breaking down the NBS report, the surplus was no fluke. In Q1 alone, exports hit N20.60 trillion, up 7.42% year-on-year, with crude oil dominating at N12.96 trillion (62.89% of the total). Non-crude exports, including liquefied natural gas (LNG) and manufactured goods, contributed N7.64 trillion, a glimmer of hope for diversification. Q2 amplified the momentum, with exports leaping to N22.75 trillion and imports dipping slightly to N15.28 trillion, yielding a quarterly surplus of N7.46 trillion, a 33.63% jump from Q1’s N5.17 trillion.

Imports, meanwhile, contracted amid tighter forex controls and a naira devaluation that made foreign goods pricier. Key inflows included refined petroleum products at N4.13 trillion, a sore point highlighting Nigeria’s paradox of exporting crude while importing fuel, alongside machinery, vehicles, and electrical equipment from powerhouses like China and India.

Top export destinations underscored Nigeria’s global pull: Spain, the United States, France, India, and the Netherlands absorbed the bulk, with crude and LNG leading the charge. On the import side, China topped the list, followed by Belgium, India, the US, and the Netherlands.

At the heart of this export renaissance lies crude oil, whose prices stabilized around $80 per barrel in H1, buoyed by global supply jitters. Yet, whispers in Abuja’s policy corridors suggest the surplus isn’t solely petroleum-powered. Non-oil exports climbed 15.38% in Q1, driven by agricultural products like cocoa and sesame seeds, plus emerging sectors such as petrochemicals and solid minerals.

“Nigeria’s aggressive push for non-oil exports through incentives like the Export Expansion Grant is paying off,” noted Bello. “But let’s not kid ourselves – oil still calls 63% of the shots. A true surplus story would see non-oil hitting 50% by 2027.”

Critics, however, temper the jubilation. Social media erupted with mixed reactions on X (formerly Twitter), where users hailed the news as a “win for Tinubu’s reforms” while decrying the fuel import bill as a “national embarrassment.” One viral post quipped: “We export black gold and import white elephant fuel – time to fix the refineries!”

Indeed, the N4.13 trillion spent on imported fuel in six months underscores structural frailties. Despite the Dangote Refinery’s commissioning, delays in crude supply have kept the taps trickling, forcing reliance on overseas refined products. Economists warn that without ramped-up local refining and agro-industrialization, the surplus could evaporate if oil prices dip below $70.

Read also:

- Nigeria imports durum wheat worth N1.29tr

- Oyetola vows to end Fish importation, launches aggressive push for local production in Nigeria

- US slams Nigeria’s import ban on 25 items, warns of lost revenue for American Exporters amid tariff war

For a nation reeling from 34% inflation and naira woes, the surplus is manna. It bolsters foreign reserves, now hovering at $35 billion, and eases pressure on the Central Bank of Nigeria’s interventions. The IMF has nodded approval, projecting Nigeria’s current account balance to swell to $1.43 billion for the full year – up from $1.21 billion in 2023.

Bilateral ties are thawing too. Intriguingly, the US flipped its trade ledger with Nigeria into a $576 million surplus in H1, exporting $3.34 billion in goods (up 41%) while importing $2.76 billion (down 12%). This reversal, amid tariff tussles, could pave the way for deeper US-Nigeria pacts on critical minerals and tech.

Yet, as Dr. Bello cautions, “Surpluses buy time, not transformation. Job creation in exports must triple to dent youth unemployment at 40%. And with elections looming in 2027, this could be Tinubu’s economic ace – if he plays it right.”

As Nigeria savors this historic pivot, the world watches. Will the Giant of Africa finally stand tall on balanced legs, or will oil’s shadow loom large? For now, the ledger glows green – a rare sight in the annals of Nigerian commerce.