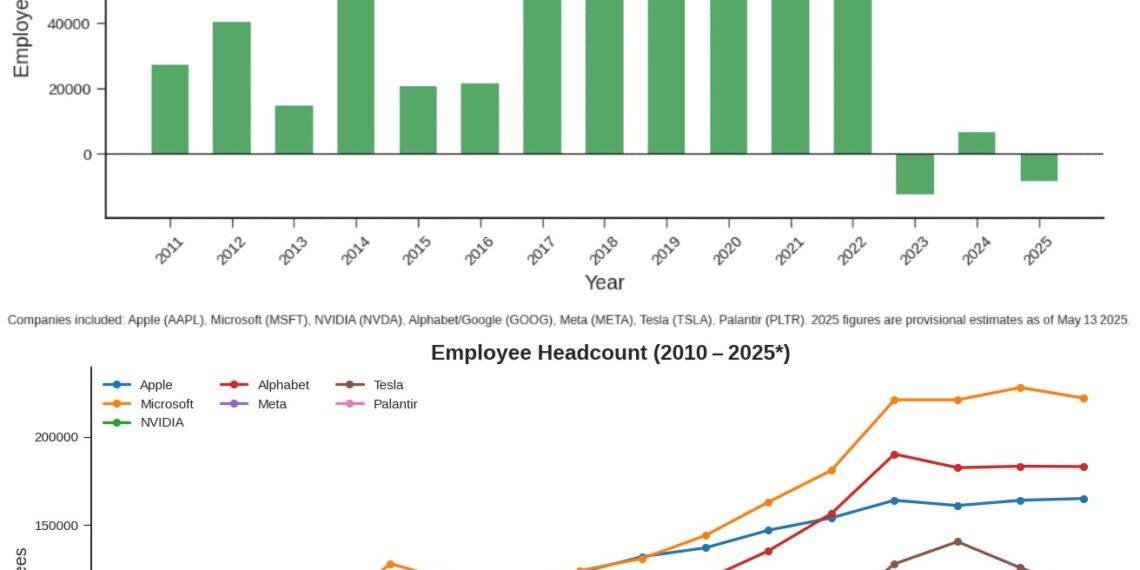

Over the past three years, the once-explosive Big Tech job market has ground to a halt. From 2022 to 2025, companies like Google, Apple, Meta, Amazon, Microsoft, and others have seen zero net growth in headcount, marking a stark shift from the hiring frenzy of the past decade. The golden era of tech jobs, where computer science graduates walked into six-figure salaries and unlimited perks, appears to be over, at least for now.

This hiring freeze isn’t just a bump in the road. It’s a full-blown shift in the industry’s trajectory, driven by economic pressures, market saturation, AI-driven efficiencies, and cautious corporate strategies. Data from industry sources and layoff trackers like Layoffs.fyi reveal a chilling picture: between 2022 and 2024, companies cut tens of thousands of jobs. Meta alone slashed 21,000 positions in 2023, Google eliminated 12,000 roles, and Microsoft downsized by 10,000. The result? A complete stall in job creation across the sector.

Compare this to the 2010s, when Big Tech couldn’t hire fast enough. Back then, companies were expanding into AI, cloud computing, e-commerce, and social media at record pace. But in today’s landscape, the rules have changed. According to U.S. Bureau of Labor Statistics data, tech industry job growth has fallen to just 0.2% annually since 2022: a dramatic drop from the 4-6% growth of previous years.

So, what caused this freeze in one of the world’s most innovative industries?

It starts with the pandemic. During COVID-19, Big Tech companies ramped up hiring to meet skyrocketing demand for digital services. With interest rates at rock-bottom levels, they were flush with capital and optimistic about permanent growth. But post-pandemic reality hit hard. Inflation, rising interest rates, and market corrections exposed a massive overhiring problem. Revenue growth slowed, while CFOs were forced to tighten budgets, prioritizing profit margins over headcount.

Meanwhile, Big Tech’s core markets have matured. Google still dominates search, Amazon leads in e-commerce, and Meta remains king of social media. With fewer new frontiers to conquer, the need for large-scale hiring has dropped. Instead, companies are focusing on doing more with less, largely through AI and automation.

Read also:

- Humans defeat robot runners in Beijing’s half-marathon

- Journalists admonished to use Cybernetics, Robotics for news gathering

- Elon Musk’s Neuralink wants to embed microchips in people’s skulls and get robots to perform brain surgery

Artificial intelligence is replacing tasks that once required armies of human workers. From warehouse operations at Amazon to AI-driven content moderation at Meta, productivity is soaring even as headcount stays flat. The message is clear: scaling up no longer means hiring more people; it means building better machines.

Regulatory pressure has also slowed hiring. Antitrust lawsuits, data privacy concerns, and intense government scrutiny in the U.S. and Europe have pushed companies to pull back from high-risk, high-cost ventures that previously fueled aggressive hiring sprees. Meta’s retreat from the metaverse is just one high-profile example.

Add in the rise of remote work and global hiring, and the situation becomes even clearer. With companies now able to tap into cheaper labor markets in Eastern Europe, Africa, and Asia, the traditional tech hubs like Silicon Valley, Austin, and Seattle are feeling the squeeze. Domestic hiring has taken a hit, and wage growth is stagnating.

For workers, the impact is massive. Landing a job at a top tech firm is now more competitive than ever. Entry-level opportunities are rare, and even experienced engineers face intense competition. The once-famous tech salaries are still high, but they’ve stopped climbing. A 2024 report by Levels.fyi found that compensation growth has slowed to just 1-2% annually, down from the 5-10% jumps seen before 2022.

Job insecurity is the new norm. Even those still employed in Big Tech report heavier workloads and heightened pressure to perform. Meanwhile, many are leaving the giants altogether, opting instead to join smaller startups and mid-size firms, where risk is higher but opportunities for impact and equity still exist.

The ripple effects extend beyond tech campuses. Cities like San Francisco, once booming thanks to tech, are now seeing falling demand for office space and shrinking local economies. Entire industries built around the lavish spending of tech workers from luxury dining to co-working spaces are feeling the downturn.

Is this the new normal for Big Tech? Maybe. Maybe not. Executives are beginning to ask: “Do we really need 400,000 employees to grow the business, or can AI do the heavy lifting?” Some believe this is just a pause, a post-COVID correction that will give way to another wave of hiring. Others think the industry has fundamentally changed—that the age of hypergrowth is over, and the future will be leaner, smarter, and more automated.

Still, not all hope is lost. While mass hiring may be off the table, targeted roles in AI ethics, cybersecurity, sustainable tech, and data privacy are seeing renewed interest. For job seekers, adaptability is key. Upskilling in these emerging areas, building personal networks, and considering roles outside the Big Five may offer a path forward.

In the end, the Big Tech job freeze isn’t just a blip; it’s a signal. The giants of the industry are no longer growing their workforces at breakneck speed. For professionals in tech, that means it’s time to rethink, retool, and prepare for a future where resilience, creativity, and flexibility matter more than ever.