In a jaw-dropping power move, BlackRock, the American financial juggernaut, has sealed a historic $23 billion deal to acquire two major ports in Panama—marking a significant shift in global economic influence. The acquisition comes just months after former U.S. President Donald Trump’s relentless criticism of Panama’s control over its prized asset, the Panama Canal.

The mega-deal, led by BlackRock’s infrastructure powerhouse Global Infrastructure Partners (GIP), will see the firm take over 90% of Panama Ports Company, which operates the critical Balboa and Cristobal ports—gateway points to the Panama Canal. These ports, along with 40 others, were previously owned by Hong Kong’s CK Hutchison, a conglomerate under the influence of Asia’s wealthiest Li family.

Trump had long decried Panama’s handling of the canal, arguing that it was charging excessive fees. His push for greater American control over the strategic waterway has now been bolstered by this massive takeover. The former president had even suggested that the United States should “retake” control of the canal, which was handed over to Panama in 2000.

Despite the geopolitical undercurrents, Panama’s President, José Raúl Mulino, attempted to downplay the deal’s significance, labeling it a mere “global transaction between private companies.” However, insiders suggest that political pressure played a crucial role in CK Hutchison’s decision to exit the port business.

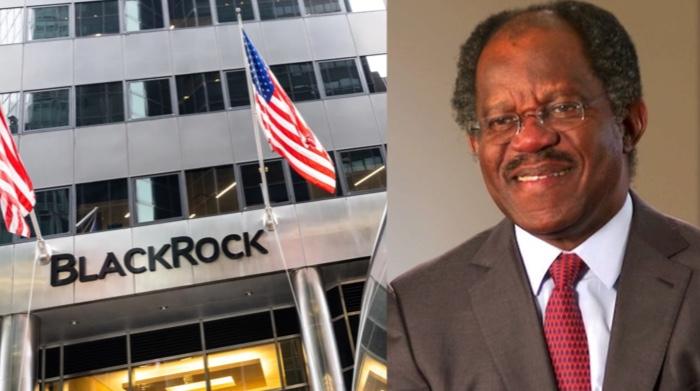

Adebayo Ogunlesi, the influential Nigerian-born Chairman & CEO of Global Infrastructure Partners, is leading this high-stakes acquisition. Under Ogunlesi’s leadership, GIP has amassed a staggering $100 billion in assets, solidifying its dominance in global infrastructure investments.

As part of the agreement, BlackRock and GIP will manage the newly acquired assets alongside Terminal Investment Limited (TIL), a major player in port operations. The move cements BlackRock’s aggressive push into infrastructure investments beyond its traditional stock and bond portfolios.

Read Also: Nigerian youngsters shine at US chess championship

The high-profile acquisition unfolded over weeks of discreet negotiations between the BlackRock-led consortium and CK Hutchison’s top executives. Sources reveal that the Li family was under growing political pressure to offload its port assets, particularly those linked to the Panama Canal. The family sought an American buyer, and BlackRock’s proposal edged out three other competitive bids.

A joint statement by BlackRock and CK Hutchison confirmed the deal, pending final regulatory approvals from the Panamanian government. The agreement includes exclusive negotiation rights, a non-disclosure arrangement, and due diligence procedures set to conclude before April 2025.

Larry Fink, BlackRock’s Chairman and CEO, called the acquisition a “powerful illustration” of the firm’s ability to secure high-impact investments.

“These world-class ports facilitate global growth,” Fink said. “With our deep industry connections and strategic partnerships, we are increasingly becoming the first call for major deals. Our clients will directly benefit from this investment.”

Ogunlesi echoed similar sentiments, emphasizing GIP’s expertise in managing top-tier port operations. “Our ambition is to elevate these ports to world-class standards—efficient, competitive, and commercially focused,” he stated.

While BlackRock celebrates its latest triumph, Trump has not backed down on his criticisms of Panama’s canal policies. The former president has repeatedly slammed the increasing tolls on shipping companies, calling them a burden on global trade. The Panamanian authorities have defended the hikes, citing climate change-induced droughts, infrastructure upgrades, and high demand as justifications.

With BlackRock now in control of key ports, speculation is mounting about whether the U.S. will further leverage its economic might to gain more influence over the canal’s operations.